Amex Points VS Chase Points: Chase and Amex offer excellent credit cards. But the best depends on where you live, what you plan to spend, and what benefits you’re looking for.

The Chase Freedom card offers 3x points on travel and dining for the first year. It also has no foreign transaction fees and no annual fee.

There are several different points-based credit cards that you can apply for. In this article, I’ll explain why I prefer the Chase Sapphire Preferred card. It’s important to note that rewards programs have some limitations. For example, you won’t be able to earn points on certain purchases, such as Amazon.

You should consider the points program because it makes you eligible for valuable perks. These include airline miles, hotel stays, and much more.

The other thing that you should know is that these perks don’t expire. This means that you can keep reaping the rewards from them forever.

But since the Chase card offers more spending options, it’s more useful for everyday purchases. So if you’re looking for a credit card for everyday use, this may be a good option.

Which is better?

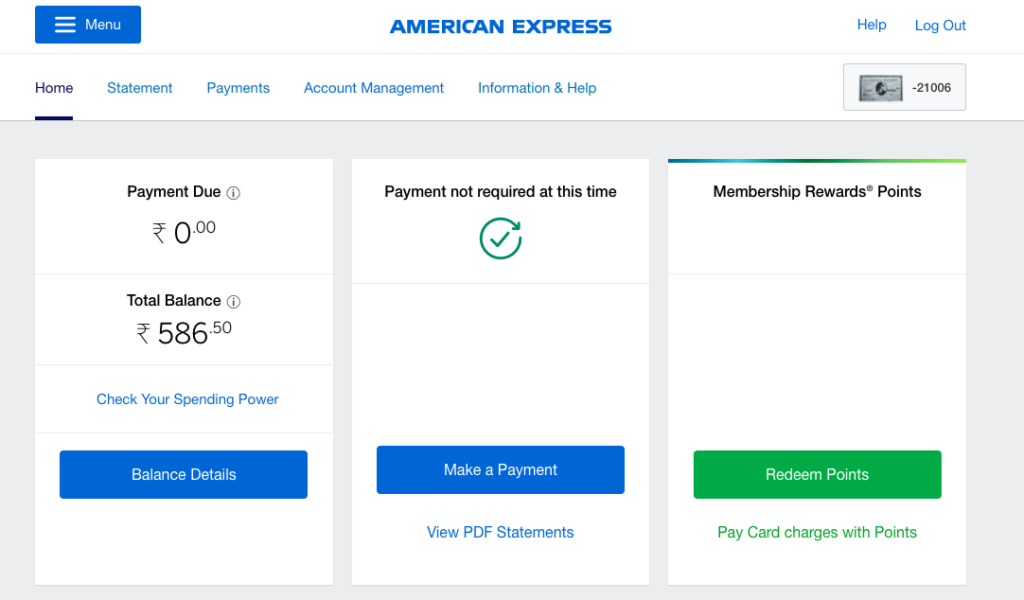

The first step is to apply for an Amex card. You can do this by visiting their website and clicking the Get Started button.

You can also apply for one on your mobile device. Just go to the Amex website and log in to your account. Once logged in, go to the “Apply for Card” section.

After you’ve applied, they’ll send you a verification code via text message. Enter it on your mobile phone when prompted.

Afterward, you must set up your new card with your billing information and address. Once you’ve done this, you can start earning Amex Points. Every dollar spent with your card will make you 1 point.

Chase vs. Amex

The only difference is the number of points earned per dollar spent. Chase has 2x the number of points than Amex. So if you are looking for a card with more issues, I suggest going with Chase.

Undoubtedly, Amex is one of the most well-known credit cards. It’s also one of the best for travel rewards.

It’s also important to know that Chase is just as good of a card as Amex. The only difference is that you won’t earn as many miles or points on the Chase card as you will on the Amex card.

Both cards have many perks and benefits, so it comes down to how much you will spend on the card. If you plan on spending a ton of money each month, I would go with Chase.

But if you plan on spending less money each month, you should consider Amex.

Points are points

If you want to earn points while traveling, consider using your American Express card. This card allows you to earn rewards points when you pay for your purchases.

Chase has a similar program called Chase Ultimate Rewards, designed to reward frequent travelers.

So here’s the deal. If you’re looking to earn the most points, go with Amex. If you want to maximize your reward points, go with Chase.

The best part is that you can earn these points even when you’re not traveling. The annual fee on both cards is $95 per year.

Since both programs are well-known and have been around for a long time, I didn’t think it was necessary to compare them. But since some people seem interested in this topic, I thought I would look.

Chase Points vs. Amex Points

As you can see, the key differences between these two credit cards are their respective rewards programs. But you should know that they’re not the only factor to consider.

When you’re ready to purchase, Amex will reward you with cash back at various retailers. For example, you could earn 2% back at gas stations, grocery stores, and department stores. Meanwhile, Chase will pay you points that can be redeemed for travel rewards.

You may be wondering what points are and how they work. I’ll explain everything you need to know about issues, including which is better for you.

If you have a card with Amex or Chase, you must decide which you prefer.

Amex offers more travel and dining benefits than Chase, but Chase has higher cashback bonuses.

Frequently Asked Questions (FAQs)

Q: What is the difference between American Express points and Chase points?

A: Chase has more benefits, but American Express is easier to redeem. American Express has more miles per dollar, but Chase has better bonus categories.

Q: Is there a card with fewer rewards?

A: Yes, but it would have a higher annual fee. My favorite card is the American Express® Gold Card from Chase. It has fewer points for the same price, but if you can live with a slightly higher fee, you’ll receive more points per dollar spent.

Q: Why would you choose Amex over Chase?

A: For travel rewards, Amex has a better offer. With Chase, you earn 1 point for every dollar spent. With Amex, you earn 3 points for every dollar spent. So, it’s more lucrative.

Q: What is the difference between American Express points and Chase points?

A: Amex Points are what you earn on purchases when using your card to pay, whereas Chase points are what you make when you use other cards and don’t use your Amex card.

Q: What would you recommend I do to earn the most points?

A: If you want to maximize the number of points you earn, make sure that you spend the most money possible when you shop with your Amex card and also use your Amex card whenever you can.

Myths About Points

1. Chase points and Amex points are the same.

2. They both have a value of 1 point.

3. You can earn 5,000 points on one transaction.

Conclusion

As I mentioned in the beginning, the main purpose of this article was to introduce you to the Amex Points program and show you how to use it to earn money online.

However, to earn money, you must first have something to sell. So before you can go and purchase items on Amazon or any other marketplace, you need to make some Amex Points.

So, you’ve read the reviews and researched, and you’re ready to start earning points.

You’ll get points on every purchase when you open an Amex card. You’ll earn cash back on specific purchases when you use your card.

Chase lets you earn points from every purchase, but they don’t have a cash-back program. You can also redeem points for gift cards, merchandise, and travel.